Buying ownership stakes in growing companies at the right price and holding them for the long term is one of the most effective ways to build wealth. The following story of Kobe Bryant’s successful investment in BODYARMOR, which ended up being a 33-bagger in just four years, illustrates this point.

Finance Study

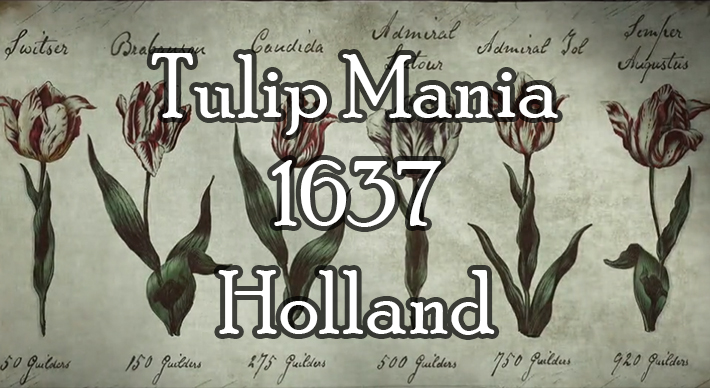

Tulip Mania, 17th century Holland – The First Financial Bubble in History

Tulip Mania was the first economic bubble recorded in history. It took place in Holland from 1633 to 1637 during the Dutch Golden Age in 1600 to 1720 when Holland boasted the highest per capita income in the world.

The South Sea Bubble – 1720 – Great Britain

This is the bubble that birthed the word “bubble.” It led to 5 banks shutting down, riots in London, aristocrats losing entire fortunes, and suicides.

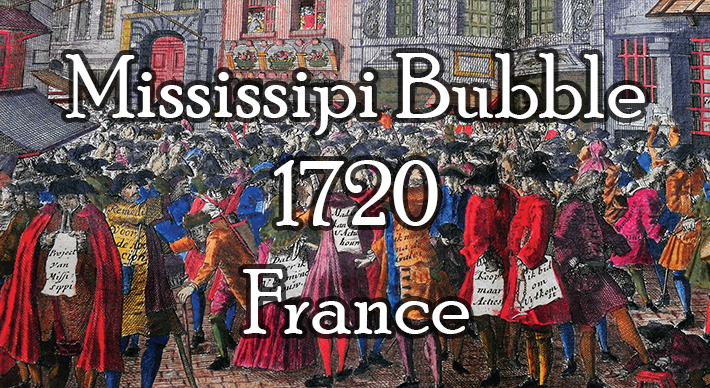

Mississippi Bubble – 1720 – France

Ever wonder when the word “millionaire” was invented? The word “millionaire” was coined in France during the Mississippi Bubble in 1719, when ordinary people were getting rich from buying stock in the Mississippi Company.