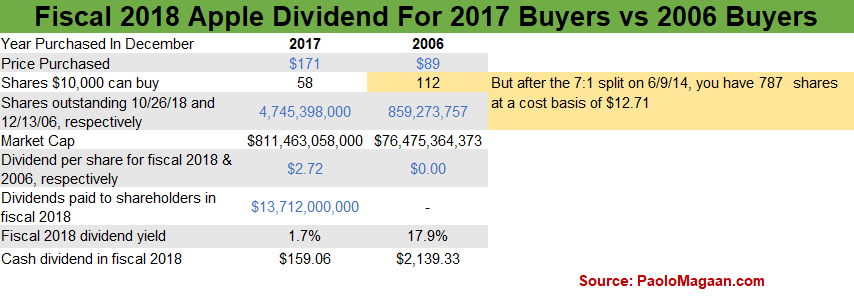

If you had bought Apple stock in December 2017 at $171 per share, you would have only received a 1.7% dividend throughout fiscal 2018.

But if you had bought Apple stock in December 2006 at $89 per share (prior to the 7-for-1 split on June 9, 2014), you would have received nearly an 18% dividend throughout fiscal 2018.

In December 2017, $10,000 could only afford you 58 shares of AAPL at $171, but that same $10,000 would have allowed you to buy 112 shares at $89 in December 2006. Those 112 shares would have eventually split into 787 shares after the 7:1 split on June 9, 2014, making your cost basis $12.71 per share.

In 2018, the 2017 investor would only be receiving $159.06 of dividends, while the 2006 investor would be receiving $2,139.33, or 1,245% more.