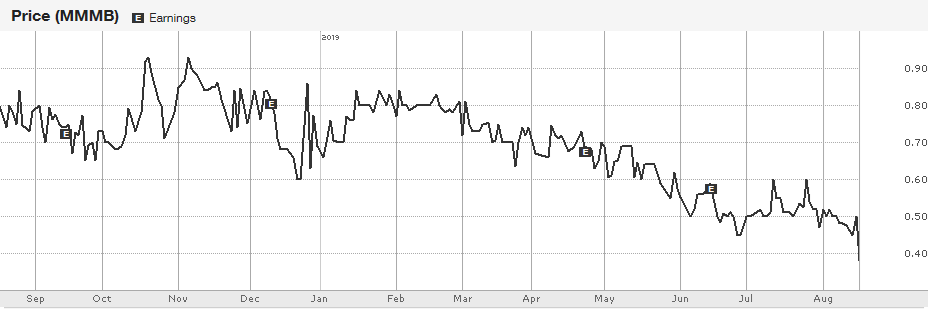

The market often swings between over-optimism and over-pessimism. Right now, the market for MamaMancini’s stock (OTCQB: MMMB) has gotten way too pessimistic. The stock’s decline over the past 6 months is uncalled for.

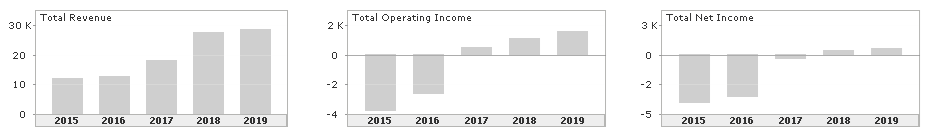

Mamamancini’s, a New Jersey producer of packaged and fresh Italian food nationwide, achieved profitability in the last two years. In fiscal 2019, the company produced $28.5 million in net sales.

But over the past 6 months, the market has sold the stock below $0.40/share, which is about $12 million in market cap. $28.5 million in net sales and a $12 million valuation is only 0.4X sales. This is a ludicrous valuation, considering that the company is nowhere near finished growing. There’s plenty of untapped market left in the U.S. particularly on the West Coast. The company has launched new products which they are selling to current and new channels. And the company has recently launched into the fresh foods segment. Yet their stock chart looks like this:

So why is there such a disconnect been value and share price?

Simple: The market has come to expect high revenue growth from MMMB every quarter, but revenues decreased in the last 3 out of 5 quarters, and fiscal 2019 only had a 3.6% increase in net sales compared to fiscal 2018’s 52.6% increase.

Below are MMMB’s net sales compared with the previous year’s comparable quarter, and the percentage increase or decrease:

April 30, 2019: $7,364,824 – 4.87% decrease

April 30, 2018: $7,741,994

January 31, 2019: $6,896,441 – 11.91% decrease

January 31, 2018: $7,829,245

October 31, 2018: $8,242,847 – 12% increase

October 31, 2017: $7,351,355

July 31, 2018: $5,640,830 – 19% decrease

July 31, 2017: $7,005,434

April 30, 2018: $7,741,994 – 45% increase

April 30, 2017: $5,357,301

Here are MMMB’s net sales over the last 3 fiscal years:

FY January 31, 2019: $28,522,112 – 3.6% increase

FY January 31, 2018: $27,543,335 – 52.6% increase

FY January 31, 2017: $18,048,792

The Story Behind the Numbers

It’s easy to see how shareholders, who have hung their hats on MMMB’s high double-digit revenue growth as the company became profitable two years ago, assumed that the revenue slowdown was due to weakening product demand. Combined with all the recent hype surrounding Beyond Meat (BYND), who produces vegan meat, I can see how shareholders of MMMB sold without digging deeper to understand the true story behind the numbers.

MMMB’s management clearly stated that they were focused on other parts of the business, and now the second half will be focused completely on sales. President and COO Matt Brown said on the June 14, 2019 earnings call:

A quick reminder for those who had not heard me talk about it over the past year, but for the last several quarters we have remained focused on plant expansion and efficiencies. With the necessary pieces in place we are now turning our focus for the remainder of fiscal 2020 towards expanding sales both in existing and new market segments. As we look towards the next quarter, we will expect to begin to see some of this sales growth unfold and we’re very proud of the team for all the hard work to date.

Some of the things we focused on expanding are product offerings, upgrading our equipment and manufacturing capabilities and moving into new markets. On the product front, we initiated first production of several new products in Q1 such as the aforementioned pasta bowls by Carl for both retail and food service markets. Pasta bowls consist of spaghetti and meatballs, chicken parmesan over penne pasta, chicken alfredo over a fettuccine pasta, and a sausage pepper and onions also over a penne pasta. We have received encouraging feedback from a major restaurant chain for these pasta bowls and believe that these products will see wide adoption over time.

We also continue to expand our customer footprint. To that end in the first quarter of 2020 we commenced initial shipments of nine new products to newly acquired customers including Walmart, BJ’s Club Stores and Ahold, which we also know as Stop & Shop among other household names. [Paolo’s note: revenues from this will materialize in the upcoming quarters, not this quarter. Some investors wrongly assumed that the new products had no traction because they didn’t see it move the needle on top-line revenue. It’s too early to make that conclusion.] As previously noted, we recently upgraded our equipment and expanded our production capabilities in a meaningful way all in an effort to increase our capacity while at the same time make us more efficient in production. This not only provides us with the ability to grow existing sales, but also move into other markets such as the large and growing food service market, which does present an incredible opportunity for MamaMancini’s. I’ll speak more on that food service market in the moment.

We are also proud to have finalized construction on our newly completed in house state-of-the-art laboratory, we intend to move all of our outside lab testing to this facility over time. Currently, we have moved all of the micro testing in house to this lab and continue to work towards the ability to run our nutritional analyses as well, which should save us somewhere in the range of 800 per analysis so over the course of the year that can be a substantial amount of savings. So in a nutshell our new production and lab efficiencies are expected to improve our margin profile while helping us to control quality and more rapidly expand.

Finally, as noted earlier, the food service market does present a significant opportunity for our company and one that we are aggressively pursuing. To that end in April, we hired Allan Sabatier, as our Vice President of Business Development to lead these efforts. The food service channel has the potential of being larger than the grocery store channel in which we currently compete and could more than double our addressable market. Allan brings a wealth of perishable foods industry experience to MamaMancini’s, as a previous senior executive in sales and marketing for major food companies including Dole, Del Monte, Ready Pac Foods and ConAgra.

Think of it like re-sharpening an axe before whacking away at a partially-cut tree. With management focusing on operating efficiencies for a few quarters, sales were not being pushed. But that never meant that the company was done growing, or that their products had gone out of favor. Far from it.

They Weren’t Lying

In fact, MMMB reported preliminary results today for the quarter ended July 31, 2019 (fiscal 2Q20). And what do you know, lo and behold, the company is back to strong double-digit growth: The company expects to report 38% revenue growth to at least $7.8 million next month (Sept. 14), and net income improving significantly to at least $250,000. That’s a net income run rate of $1 million, which puts this growth company’s valuation at only 12X earnings.

MMMB is clearly a steal here, and I am a buyer.

Disclosure: I am long MMMB. This article expresses my opinions only, and is not to be misconstrued as investment advice or a recommendation to buy or sell stock. For more information, refer to the Terms of Use.