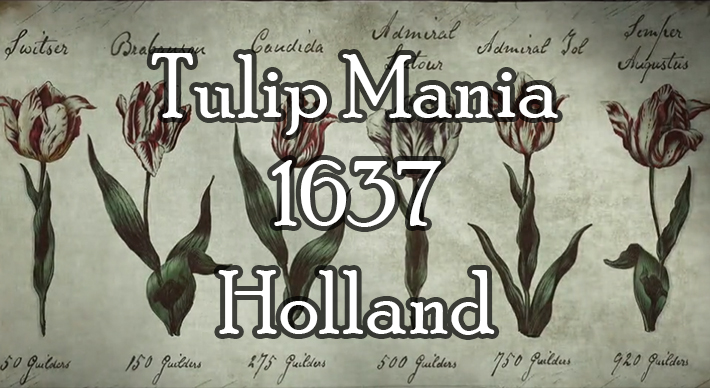

Tulip Mania was the first economic bubble recorded in history. It took place in Holland from 1633 to 1637 during the Dutch Golden Age in 1600 to 1720 when Holland boasted the highest per capita income in the world.

Tulips were colorful flowers imported from the Ottoman Empire (present-day Turkey) and quickly became popular in Dutch paintings and festivals.

Aside from being pleasing to look at, tulips had little intrinsic value. They did not have long lifespans, either. In 17th century Holland, tulips were—from a gardener’s perspective—treated as “annuals”, or plants that complete their entire life cycle in just one growing season.

Dutch traders during the four-year-long bubble only bought the tulips as a vehicle for speculation. Most of these traders never saw the tulips they so heavily spent on, since they were traded through futures contracts. The Dutch bought tulips at maniacal prices for the same reason modern speculators borrowed money against their own houses to buy Bitcoin in December 2017, despite its unreliability as a currency due to its volatility: because the market was strong, kept rising, and the more people heard about others getting rich from “investing” in it, the more people rushed in to seek their own fortune.

With many tulip exchanges available, even the poor could buy and sell tulips with ease. Markets were liquid enough that some bulbs were reported to have changed hands ten times in a single day.

12 acres of land was once offered for a single bulb from a rare tulip known as the “Semper Augustus” according to 19th century British journalist, Charles Mackay. But in 1637, buyers at inflated prices could no longer be found, and the market collapsed.

What Tulip Mania Taught Modern Investors

The reason any serious investor or trader should study historical bubbles and crashes like Tulip Mania is best articulated by Eleanor Roosevelt:

“Learn from the mistakes of others. You can’t live long enough to make them all yourself.”

People today are the same as people 400 years ago

People today are no different than people 400 years ago: they want to get rich quick, and they’re willing to dispose of their sense of reason in order to do so.

Before you judge them, know that the potential for irrational, greedy behavior exists in you, too. How many times have you bought a stock simply because it was rising? How many times have you passed on a stock because it was too expensive, only to see someone else make a fortune from it (even though the move was intrinsically unwarranted), and suddenly feel like a loser for not having participated? (see my article about FOMO, “Fear of Missing Out”.)

It’s usually better to ride a bubble than to short it

Although the causes for bubbles tend to be similar, the timings of their crashes are always unpredictable. Sometimes they only take a few weeks to unravel, while other times it may take months or years. So if you’re hell-bent on trading the bubble, oftentimes it’s better to ride the bubble than to try and short it, especially early on.

Renowned trader, George Soros, has a penchant for this behavior, which he justifies with his Theory of Reflexivity. In 2009, Soros stated, “When I see a bubble forming, I rush in to buy, adding fuel to the fire.”

However, the tricky part of trading bubbles is knowing when to sell. No one knows where the peak is. For example, if you were a Dutch trader in the 17th century, should you have been happy to sell a single tulip for 12 acres? Or would you have kicked yourself when you found out that someone else sold their tulip for more than 300 times a skilled laborer’s annual earnings?

But it might be best to just avoid it altogether

Greed is a dangerous game, and when valuations are stretched beyond reason and propped up only by the hysteria of speculators hoping to sell to greater fools, there is no road map that can be followed; it’s essentially a game of musical chairs.

If you’re a risk-averse investor, the best thing to do would be to avoid the bubble altogether. When bubbles burst, stop losses fail to limit risk as everyone heads for the exits at the same time, similar to how a single lifeboat can save a few people but is rendered useless if everyone on the ship attempts to pile into it simultaneously.

Tulip Fever (2017)

Alicia Vikander starred in a 2017 period drama about Tulip Mania titled, Tulip Fever.

In Tulip Fever, the story of the main characters center around a love triangle, which artistically parallels the events of the Tulip Bubble in lockstep. As the absurdity of the characters’ audacity for betrayal reaches ever-preposterous heights, so increases the price of tulips–until the bubble bursts.

If you’re aiming to understand the history of financial crashes, get a memorable grasp of the Tulip Bubble, and also get a glimpse of what 17th century Holland was like, Tulip Fever is a must-see.